December 13, 2017, Vancouver, B.C., Metallic Minerals Corp. (TSX-V: MMG; US OTC: MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce diamond drill results from seven holes drilled on the Caribou and Duncan targets in the Keno Summit area at its 100% owned Keno Silver Project in Canada’s Yukon Territory. A total of 1,320 meters of diamond drill core was collected from 14 holes in 2017 on areas prioritized during initial exploration work, namely Caribou, Duncan and two vein targets at Homestake (see Figures 1 and 2). The results clearly show that the Caribou target is a classic Keno-type high-grade system with bonanza grades, such as hole CH017-023, which intercepted 1.6 meters grading 2,851 g/t silver equivalent (1,405 Ag g/t, 26% Pb, 3.7% Zinc and 0.28 g/t Au), and that the system is open to further expansion down dip to the north and south. Final results from 2017, including the drilling from two priority targets on the Homestake block, are anticipated in the coming weeks.

The objective at the Caribou and Duncan targets was to drill below the shallow historic mining and sampling on the structure to determine the potential of the systems to host significant high-grade silver-lead-zinc deposits and to provide vectors to assist follow-up exploration. The Company completed six drill holes that intersected the Caribou structure, with highlight assay results shown below in Table 1. One hole was drilled at the Duncan target that intersected three mineralized structural zones within Keno Hill quartzite, one of the district’s preferred host rocks, down dip from the historic mine confirming the presence of the main structural corridor. Both areas are expected to priority targets for the planned 2018 exploration program.

Table 1:Highlighted 2017 Caribou Target Area Drill Results

Hole | From (m) | To (m) | Width (m) | Ag g/t | Pb % | Zn % | Au g/t | Ag EQ g/t |

CH17-021 | 39.35 | 42.0 | 2.65 | 407 | 3.39 | 6.35 | 0.834 | 972 |

including | 39.35 | 39.80 | 0.45 | 1,607 | 15.47 | 1.70 | 0.759 | 2,487 |

39.80 | 40.85 | 1.05 | 194 | 0.94 | 9.95 | 0.718 | 827 | |

40.85 | 42.00 | 1.15 | 132 | 0.89 | 4.89 | 0.971 | 512 | |

CH017-23 | 40.7 | 42.3 | 1.6 | 1,405 | 25.98 | 3.72 | 0.282 | 2,851 |

including | 40.70 | 41.50 | 0.80 | 2,408 | 47.30 | 4.69 | 0.108 | 4,898 |

41.50 | 42.30 | 0.80 | 402 | 4.65 | 2.74 | 0.456 | 804 | |

CH17-026 | 48.62 | 50.85 | 2.23 | 59.1 | 0.82 | 4.99 | 0.960 | 440 |

including | 49.90 | 50.85 | 0.95 | 104 | 1.55 | 9.76 | 1.641 | 828 |

Silver Equivalent (Ag Eq g/t) values assume Ag $16/oz, Pb $1.10/lb, Zn $1.25/lb, Au $1,250/oz, and 100% recovery.

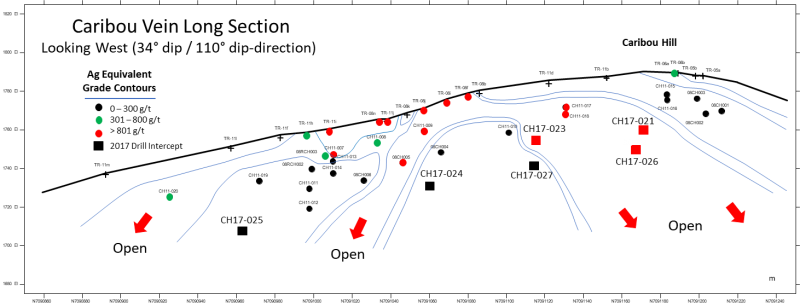

Greg Johnson, Metallic Minerals Chairman & CEO stated, “We are very pleased with the first drill results from the Keno Silver Project, which support our strategy of systematic exploration to rapidly advance targets to drill stage and potential resource delineation. At the Caribou target, our results confirm the existence of high-grade silver and that we have a well-mineralized structure that is open to depth, with widths of 1-3 meters that are typical of the Keno Hill silver district. We now have 14 intercepts grading more than 800 g/t silver equivalent on the Caribou structure with the system open to expansion to the north and south (see Figure 3 - Caribou Long Section below). To put this in context the average reserve grade for primary silver deposits in the industry is 300 g/t silver or 500 g/t silver equivalent1 with the average resource grade in the Keno district at 400-500 g/t silver. Future work at the Caribou target will focus on step out drilling of the higher-grade zones to determine the ultimate scale of the mineralized system. We anticipate conducting a robust 2018 exploration program and to continue development of the 12 priority targets, along with several new priority targets that were added through acquisitions in the district this year.”

Caribou Target Area

The Caribou target, located on the east side of Caribou Hill, was discovered and worked in the 1920s and 30s and produced 87 tons of high-grade material grading 6,072 g/t silver produced from the collective workings. A limited amount of shallow drilling and surface trenching was previously completed on the prospect between 2008 and 2011 with significant high-grade results reported (see Table 2 and 4 below).

Exploration by Metallic Minerals on the Caribou target in 2017 followed up on the historic surface work with detailed stratigraphic mapping, magnetic and VLF geophysical surveys, as well as the extension of soil sample grids over the broad target area. Diamond drilling was focused on testing down dip, along the structure below the shallow historic sampling, to determine the potential depth extension of the open-ended mineralization. The results of the drilling show a shallow dipping, well mineralized structure hosted in Keno Hill Quartzite, which hosts the majority of historic production and resources in the Keno Hill silver district (See Table 3 and Figure 3 below).

Footnote 1: New Explorer for High-Grade Silver Resources in the Prolific Keno Hill Silver District of Yukon, Canada; Michael Fowler, Loewen, Ondaatje, McCutcheon Ltd (LOM), September 2017.

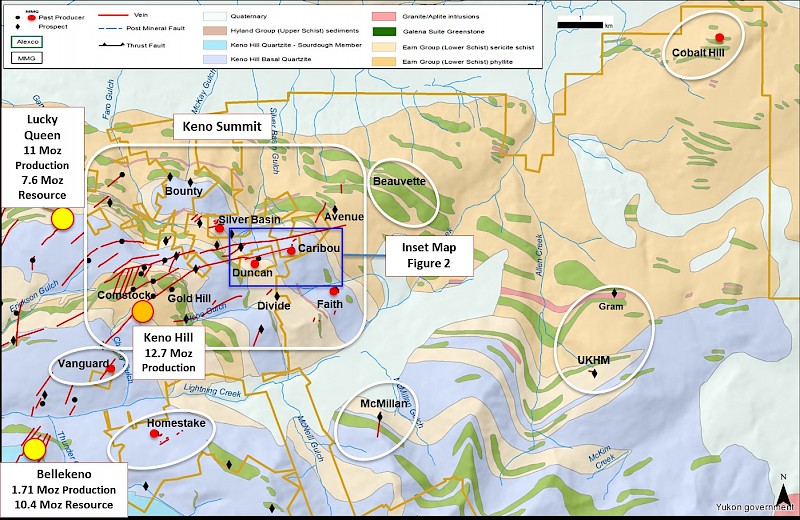

Figure 1: Keno Silver Project Priority Targets Map

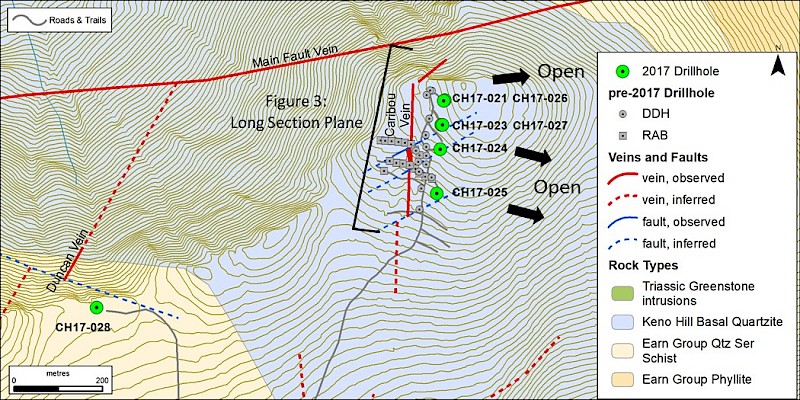

Figure 2: Caribou and Duncan Target Drill Hole Location Map

The drilling further shows that the Caribou structure is open to expansion and there remains significant exploration upside with the potential to develop a resource on this target (see long section in Figure 3 below). Drill holes are shown, with their respective grades, where they pierce the plane of the vein. Planned work for 2018 would include a continuation of step-out drilling of the shallow-dipping vein along the best mineralized shoots to the north and to the south where the high-grade mineralization remains open.

Figure 3: Caribou Vein Long Section Showing Contoured Silver Equivalent Values

Table 2: Caribou Comprehensive 2008-2011 Drill Results

Hole | From (m) | To (m) | Width (m) | Ag g/t | Pb % | Zn % | Au g/t | Ag EQ g/t |

08CH001 | 33.30 | 35.30 | 2.0 | 116.2 | 0.96 | 0.18 | 0.12 | 180 |

Including | 34.30 | 34.50 | 0.2 | 958 | 8.44 | 1.22 | 0.78 | 1482 |

08CH002 | 28.90 | 31.40 | 2.50 | 87.8 | 0.74 | 0.16 | 0.19 | 146 |

Including | 18.60 | 19.80 | 1.2 | 432 | 4.17 | 0.21 | 1.00 | 718 |

08CH004 | 33.60 | 34.60 | 1.0 | 84.2 | 0.64 | 0.39 | 0.59 | 181 |

08CH005 | 35.00 | 35.50 | 0.50 | 1046 | 3.39 | 1.44 | 0.77 | 1,343 |

08CH006 | 34.60 | 39.40 | 4.80 | 69.5 | 0.58 | 0.47 | 0.19 | 137 |

08RCH002 | 27.43 | 28.95 | 1.52 | 76.3 | 1.6 | 0.03 | 0.03 | 156 |

08RCH003 | 18.29 | 19.81 | 1.52 | 198 | 1.75 | 0.42 | 0.23 | 321 |

CH11-007 | 14.60 | 18.50 | 3.90 | 314.8 | 27.8 | 0.53 | 0.17 | 1,667 |

Including | 14.60 | 15.80 | 1.2 | 94.3 | 85.56 | 0.01 | 0.23 | 4,146 |

CH11-008 | 14.80 | 17.70 | 2.90 | 162.5 | 3.15 | 0.58 | 0.16 | 355 |

Including | 14.80 | 15.50 | 0.7 | 493 | 10.49 | 0.93 | 0.4 | 1069 |

CH11-009 | 15.50 | 16.90 | 1.40 | 1,696.3 | 9.42 | 0.94 | 0.85 | 2,257 |

CH11-010 | 30.30 | 31.00 | 0.70 | 447 | 2.34 | 3.07 | 0.35 | 749 |

CH11-011 | 39.70 | 42.10 | 2.40 | 59.7 | 0.79 | 0.79 | 0.46 | 175 |

CH11-013 | 16.50 | 20.10 | 3.60 | 168.9 | 1.37 | 0.62 | 0.1 | 274 |

Including | 16.50 | 17.70 | 1.2 | 401 | 2.95 | 1.02 | 0.2 | 610 |

CH11-014 | 20.90 | 25.70 | 4.80 | 31.4 | 0.41 | 0.39 | 0.15 | 83 |

CH11-015 | 13.50 | 18.40 | 4.90 | 129.1 | 0.9 | 0.11 | 0.02 | 179 |

CH11-017 | 22.90 | 23.40 | 0.50 | 1,610.8 | 16.83 | 1.16 | 1.26 | 2,565 |

CH11-018 | 24.10 | 25.00 | 0.90 | 1,151 | 7.16 | 1.03 | 0.05 | 1,548 |

CH11-019 | 23.10 | 25.60 | 2.50 | 20.3 | 0.45 | 1.06 | 0.13 | 108 |

CH11-020 | 21.30 | 23.50 | 2.20 | 213.5 | 1.38 | 1.06 | 0.18 | 349 |

Silver Equivalent (Ag Eq g/t) values assume Ag $16/oz, Pb $1.10/lb, Zn $1.25/lb, Au $1,250/oz, and 100% recovery. Widths believed to approximate true width.

Table 3: Caribou Comprehensive 2017 Drill Results

ID | Sample Type | Width | Ag g/t | Pb% | Zn% | Au g/t | Ag EQ g/t |

TR-05a | Channel | 2.50 | 77.6 | 0.1 | 0.16 | 0.08 | 97 |

TR-05b | Channel | 2.00 | 119.9 | 0.18 | 0.78 | 0.53 | 212 |

TR-06a | Channel | 3.50 | 282.5 | 0.41 | 0.1 | 0.17 | 321 |

TR-06b | Channel | 0.50 | 127.1 | 1.15 | 0.26 | 0.01 | 196 |

TR-08b | Channel | 1.10 | 84.3 | 0.42 | 0.47 | 0.29 | 152 |

TR-08f | Channel | 0.40 | 1026 | 2.75 | 0.64 | 0.62 | 1,238 |

TR-08i | Channel | 0.70 | 981.6 | 9.33 | 1.35 | 0.57 | 1,538 |

TR-08j | Channel | 0.30 | 1,855.7 | 41.5 | 0.05 | 0.09 | 3,822 |

TR-08k | Channel | 2.70 | 72.0 | 0.32 | 0.06 | 0.14 | 101 |

TR-08n | Channel | 1.70 | 3,332.7 | 13.88 | 1.07 | 0 | 4,044 |

TR-11f | Channel | 0.50 | 57.1 | 0.26 | 0.44 | 0.26 | 113 |

TR-11h | Channel | 1.50 | 539 | 2.13 | 1.05 | 0.25 | 715 |

TR-11i | Channel | 1.50 | 954.2 | 4.81 | 1.05 | 0.48 | 1,275 |

TR-11j | Channel | 2.00 | 2,953.1 | 8.11 | 0.64 | 0 | 3,370 |

TR-11l | Channel | 0.80 | 138.5 | 1.35 | 0.17 | 0.11 | 220 |

Silver Equivalent (Ag Eq g/t) values assume Ag $16/oz, Pb $1.10/lb, Zn $1.25/lb, Au $1,250/oz, and 100% recovery. Widths believed to approximate true width.

Table 4: Caribou Comprehensive Trench Results

Duncan Target Area

The second area targeted with drilling in the Keno Summit area was an initial test of the structure at the historic Duncan mine, which had the highest recorded grade of production in the Keno Hill silver district at 25,518 g/t silver from the shallow workings2. The Duncan vein was staked in 1919 and saw limited development work in 1920s. The vein is exposed on the steep north face above Silver Basin, which has seen only limited exploration including minor hand trenching and a few bulldozer cuts since the 1920s. Metallic Minerals completed the first known drill hole on the target from the plateau south of the prospect. This down dip test confirmed the presence of a broad window of prospective quartzite and intersected three anomalously mineralized structural zones within the Keno Hill quartzite ending in 70 g/t silver equivalent material. Drilling difficulties limited the further continuation of the hole, falling short of testing the full quartzite package. However, these results confirm the presence of the Duncan target structure, which may have up to 200 vertical meters of Keno Hill Quartzite host rock positioned down dip from the high-grade Duncan shaft, with open-ended strike potential. Follow up drilling in 2018 will be designed to test the full depth potential of this highly-prospective target.

Footnote 2: CATHRO, R. J. (Bob). Great Mining Camps of Canada 1. The History and Geology of the Keno Hill Silver Camp, Yukon Territory. Geoscience Canada, [S.l.], Sept. 2006. ISSN 1911-4850

About Metallic Minerals Corp.

Metallic Minerals Corp. is a growth stage exploration company focused on the acquisition and development of high-grade silver and gold in the Yukon within under explored districts with potential to produce top-tier assets. Our objective is to create value through a disciplined, systematic approach to exploration, reducing investment risk and maximizing probability of long-term success. Our core Keno Silver Project is located in the historic Keno Hill Silver District of Canada's Yukon Territory, a region which has produced over 200 million ounces of silver and currently hosts one of the world’s highest-grade silver resources. The Company’s McKay Hill Project, northeast of Keno Hill, is a high-grade historic silver-gold producer. Metallic Minerals is also building a portfolio of gold royalties in the historic Klondike Gold District. Metallic Minerals is led by a team with a track record of discovery and exploration success, including large scale development, permitting and project financing.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.metallic-minerals.com

Email: chris.ackerman@metallic-minerals.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Quality Assurance / Quality Control

Analytical work in 2017 was done by Bureau Veritas Commodities Canada Ltd. with sample preparation in Whitehorse, Yukon and geochemical analysis in Vancouver, British Columbia. Each rock (grab) sample was analyzed for 36 elements using an Aqua Regia digestion with inductively coupled plasma-atomic emission spectroscopy (ICP-AES) and inductively coupled Plasma-mass spectrometry (ICP-MS) (AQ202). Samples with over limit silver and gold were re-analyzed using a 30-gram fire assay fusion with a gravimetric finish (FA530-Ag, Au). Over-limit lead and zinc samples were analyzed by multi-acid digestion and atomic absorption spectrometry (MA404) or titration (GC516, GC8917). All results have passed the QAQC screening by the lab.

Qualified Person

Scott Petsel, P.Geo, Vice President, Exploration, is a Qualified Person as defined by National Instrument 43-101. Mr. Petsel has reviewed the scientific and technical information in this news release and approves the disclosure contained herein. Mr. Petsel has reviewed the results of the sampling programs and confirmed that all procedures, protocols and methodologies used conform to industry standards.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.